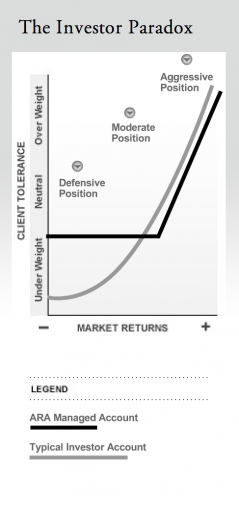

ARA helps financial advisors solve the Investor Paradox: clients seek to make money when markets go up, and preserve wealth when markets go down.

ARA employs a systematic, rules-based framework for making timely and frequent trading decisions regarding the following:

- Ability to increase or decrease risk exposures during favorable or unfavorable risk/reward scenarios

- Synthetically replicate positions when appropriate and cost effective

PROCESS

- Review client requirements

- Analyze existing positions

- Evaluate current and expected market conditions

- Execute trades

- Recalibrate exposures with market landscape